A recent post went viral for arguing that the new poverty line should be at $140,000 for a family of four (two parents, two kids).

Let’s talk about it!

While I do understand that prices have gone sky-high on a lot of things, I think it is a bit ridiculous to suggest that $140,000 is anywhere near the poverty line for most American families.

(And saying so seems insulting to those in true poverty, such as people without homes and/or regular access to food.)

The reality is that an awful lot of American families make less than $140,000 and still manage to stay housed and fed. Honestly, in many areas of the country, $140,000 would be a comfortable income, not a poverty-level income.

Obviously, every situation is different; a family in San Francisco needs more for housing than a family in South Dakota.

a South Dakota street in the town where my grandparents lived

And a family that has a child with disabilities will need more money than a family where everyone is healthy.

I’m just saying that on average, $140,000 doesn’t seem like a poverty-level income, even in these inflationary times.

And for those of us who are rock stars at stretching a dollar, a $140,000 income would feel like a whole lot to work with!

(I think Amy Dacyzyn would have a thing or two to say about this article.)

A helpless attitude leads to hopelessness

I want to be careful how I say this, because I don’t want to be offensive to people who are in overwhelming life situations. If that’s you, I’m not talking to you; I’m talking to the average person who is not in terribly extenuating circumstances.

Something I find frustrating about the types of articles like the one I shared above is that they lead to a helpless outlook, and that breeds hopelessness.

If we believe every doom and gloom piece we read, we might start to think, “Oh my gosh, I don’t even make $100,000, let alone $140,000! It’s impossible to own a home/buy a car/go to college/build a savings account/save for retirement.”, and we might not even want to try.

It is true that the costs of some things have inflated wildly, and that wages have not gone up in tandem. These things are quite out of our control.

At the same time, we do have some choices about how we spend money; not everything about our finances is out of our control.

We can choose to take a less consumerist path through life. We can live differently from the average American.

For example, we can:

- buy used

- repair things

- eat at home

- reduce our food waste

- drive older cars

- choose free/cheap entertainment

- go to a community college/apply for scholarships/use work tuition reimbursement (oh hey, that’s me!)

- live in a smaller home

- find cheap/free ways to do things (for example, my free flights with Southwest points, my free gift cards from credit card reward points, my student discount symphony tickets, and so on.)

A helpless, hopeless attitude makes it hard to want to try any of these things! And sitting in a puddle of hopelessness doesn’t do a thing to affect inflation anyway.

So for me, it always helps to go back to my “What CAN I do?” question. That’s what got me through the years of financial difficulty while I was getting divorced; a lot of things were out of my control during those years, and it helped to focus on what was in my control.

I guess what I’m trying to gently say is: a both/and approach could be helpful.

Yes, things have gotten stupidly expensive. That’s out of our control.

AND…there are still things most of us can do to positively impact our financial lives.

A little self-callout

Sometimes I think things like, “I’m SOOOOO busy. I definitely don’t have time for a daily 15-minute mobility routine.”

And then I consider that I routinely spend a lot more than 15 minutes a day doing unnecessary things on my phone!

Is it true that I am pretty busy? Yes.

But it is also true that I still have some choices about how I spend my time.

That became starkly clear to me when I stopped bed-rotting* on my work mornings; I suddenly had time to make my bed, unload my dishwasher, do my breakfast dishes, and still get to work earlier than usual.

It’s not that I didn’t have time before; it’s that I was spending the time in a way that wasn’t serving me very well.

*I know, I know, some of you hate the term. Sorry!

I got a pill container

I have gotten through my whole life without needing to take daily pills. Which means I am terrible at it! I kept forgetting to take my iron pill and my vitamin D pill.

(Still working on getting both of those bloodwork levels up to normal.)

So, I broke down and got one of those weekly pill containers, and I will say, it is helping. I only missed two days last week!

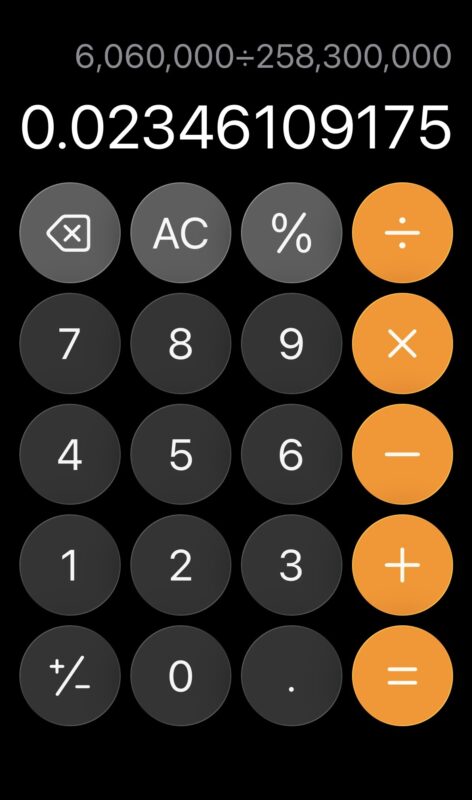

I did my math wrong

Remember my post about the penny going away? I made an error!

I corrected it in the post once a reader alerted me but: I did my math backwards when I was calculating how much the worst-case scenario of penny-rounding might affect each person.

It’s not $46/person/year, it’s between 2 cents and 3 cents/person/year!

Soooo, I don’t think any of us need to be sweating the financial impact of a penny-free United States.

(Numbers are from this article.)

Alrighty…talk to me! Any of these topics are fair game.

(I’m gonna guess the first two will be the most discussed, though!)

Source: www.thefrugalgirl.com…